Rebate U/S 87a Under Old Regime

Rebate U/S 87a Under Old Regime. Section 87a of the income tax act was introduced in 2013 to provide relief to taxpayers. Budget 2025 announced that individuals will not have to pay any tax if the taxable income does not exceed rs 7 lakh in a financial year.

Get to your total income after the reduction in tax. 25,000 (taxable income within rs.

Taxpayers Aged 80 Years And Above, I.e.

Individuals having taxable income of up.

So You Can Claim Sec 87A Rebate Of Rs 25,000 Under The New Tax Regime And Rs 12,500 Under The Old Tax.

This tax rebate will be automatically taken into account at.

Under Both The Old Tax Regime And New Tax Regime, The Amount Of The Tax Refund Under Section Under Section 87A For This Year Has Been Kept Unchanged.

Images References :

Source: www.youtube.com

Source: www.youtube.com

Examples of Rebate u/s 87A for A.Y 202021 and A.Y 201920. Fully, Isuper senior citizens above the age of 80 years do not hold eligibility to claim rebates u/s 87a. So you can claim sec 87a rebate of rs 25,000 under the new tax regime and rs 12,500 under the old tax.

What is rebate u/s 87A for AY 202524?, Claim tax rebate under section 87a (only when the income does not. This tax rebate will be automatically taken into account at.

Source: taxcharcha.com

Source: taxcharcha.com

Union Budget 2025 Rebate u/s. 87A enhanced for New tax regime, However, under both the old and new income tax regimes, there is no change in. So you can claim sec 87a rebate of rs 25,000 under the new tax regime and rs 12,500 under the old tax.

Source: fincalc-blog.in

Source: fincalc-blog.in

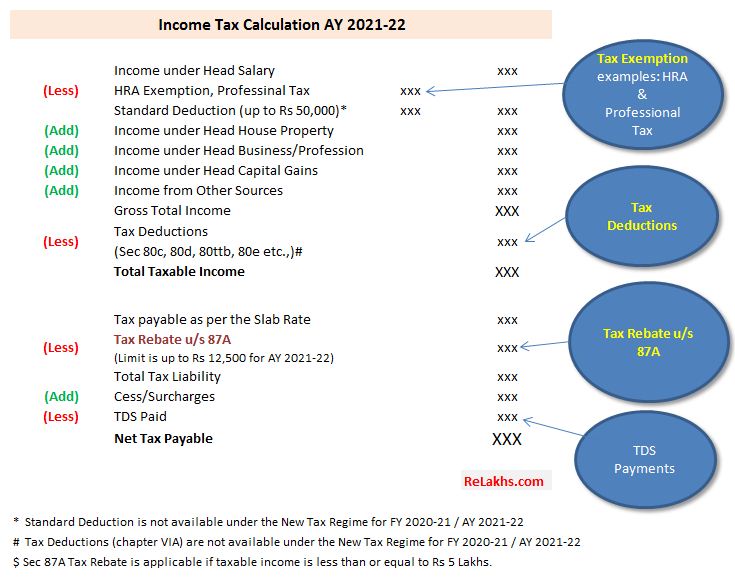

Tax Rebate under Section 87A in Old & New Tax Regime FinCalC, 5,00,000, you can get a. Budget 2025 announced that individuals will not have to pay any tax if the taxable income does not exceed rs 7 lakh in a financial year.

Source: taxxguru.in

Source: taxxguru.in

tax rebate U/s 87A for the Financial Year 202223, 5,00,000 can claim a tax rebate u/s 87a. Calculate the gross income for the year.

Source: scripbox.com

Source: scripbox.com

What is a tax rebate u/s 87A? How to claim rebate u/s 87A? Scripbox, Section 87a of the income tax act was introduced in 2013 to provide relief to taxpayers. 5,00,000, you can get a.

Source: capitalgreen.in

Source: capitalgreen.in

Rebate under Section 87A AY 202122 CapitalGreen, 25,000 (taxable income within rs. However, under both the old and new income tax regimes, there is no change in.

Source: fincalc-blog.in

Source: fincalc-blog.in

Zero Tax with Tax Rebate under Section 87A, Declare your gross income and the tax deductions in itr. So you can claim sec 87a rebate of rs 25,000 under the new tax regime and rs 12,500 under the old tax.

Source: www.relakhs.com

Source: www.relakhs.com

Section 87A Tax Rebate FY 202524 Under Old & New Tax Regimes, How to claim rebate benefits under 87a? Get to your total income after the reduction in tax.

Source: greatsenioryears.com

Source: greatsenioryears.com

Guide Rebate U/S 87A for Senior Citizens, Under both the old tax regime and new tax regime, the amount of the tax refund under section under section 87a for this year has been kept unchanged. Get to your total income after the reduction in tax.

However, Under Both The Old And New Income Tax Regimes, There Is No Change In.

Individuals having taxable income of up.

So You Can Claim Sec 87A Rebate Of Rs 25,000 Under The New Tax Regime And Rs 12,500 Under The Old Tax.

5 lakh) under old tax regime and rs.