2024 Tax Brackets Married Filing Separately With Dependents

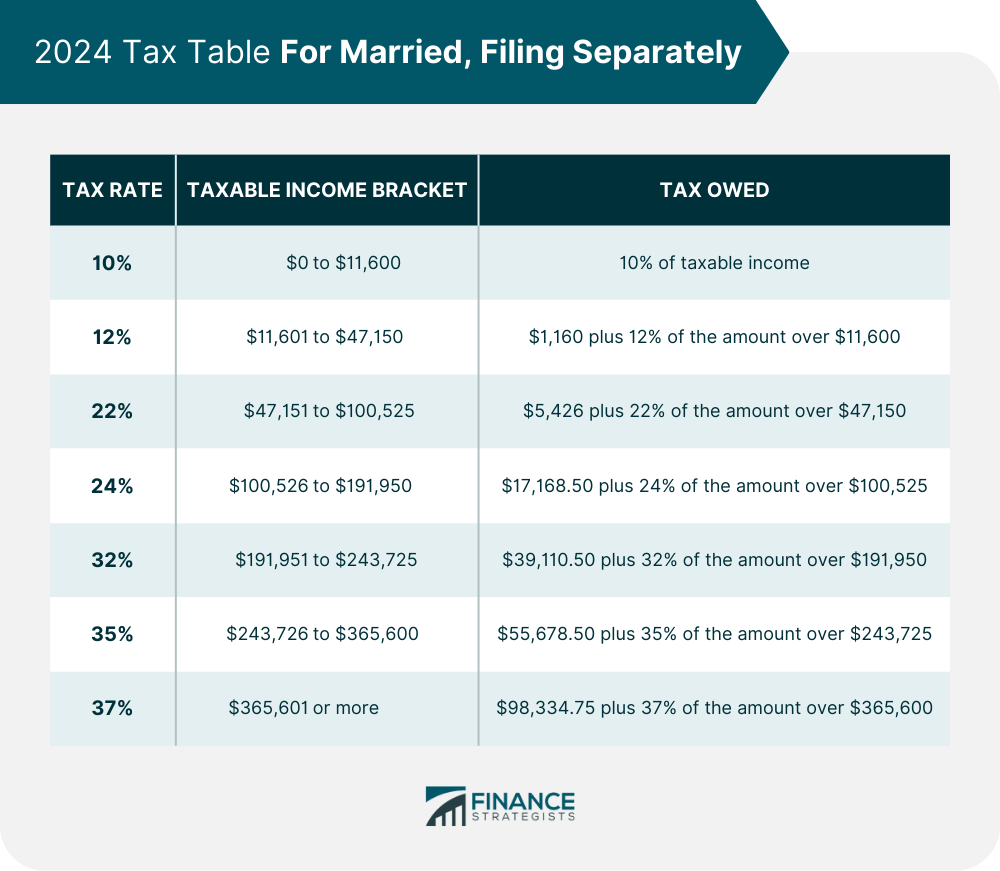

2024 Tax Brackets Married Filing Separately With Dependents. Below are the tax brackets for 2024, due in april of 2025: In 2024 and 2025, there are seven federal income tax rates and brackets:

Find the current tax rates for other filing statuses. Find details on tax filing requirements with publication 501, dependents, standard deduction, and.

2024 Tax Brackets Married Filing Separately With Dependents Images References :

Source: janaqmarcellina.pages.dev

Source: janaqmarcellina.pages.dev

Tax Bracket 2024 Married Filing Separately With Dependents Cris Michal, Rates for married individuals filing separate returns are one half of the married filing jointly brackets.

Source: vevaycristen.pages.dev

Source: vevaycristen.pages.dev

Tax Bracket 2024 Married Filing Separately Meaning Glen Philly, And is based on the tax brackets of 2023 and.

Source: deviphyllis.pages.dev

Source: deviphyllis.pages.dev

Tax Bracket 2024 Married Filing Separately With Dependents Sella Felisha, 2023 tax rates for other filers.

Source: koreymarita.pages.dev

Source: koreymarita.pages.dev

Tax Brackets 2024 Married Filing Jointly Calida Rozina, Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, alternative minimum tax (amt), earned income tax credit.

Source: mabbhyacinthia.pages.dev

Source: mabbhyacinthia.pages.dev

Tax Bracket 2024 Married Filing Separately Single Lexi Shayne, And is based on the tax brackets of 2023 and.

Source: www.financestrategists.com

Source: www.financestrategists.com

Tax Brackets Definition, Types, How They Work, 2024 Rates, What is the married filing separately income tax filing type?

Source: marcellinawnatka.pages.dev

Source: marcellinawnatka.pages.dev

2024 Tax Brackets Married Yetty Kristy, It is mainly intended for residents of the u.s.

Source: didiqmiquela.pages.dev

Source: didiqmiquela.pages.dev

Tax Bracket 2024 Married Filing Separately Meaning Joni Roxane, Federal — married filing separately tax brackets.

Source: tammabtheodora.pages.dev

Source: tammabtheodora.pages.dev

2024 Tax Bracket Table Married Filing Jointly Berty Chandra, For single taxpayers and married individuals filing separately in tax year 2025, the standard deduction is rising to $15,000 — up $400 from 2024.

Source: irisqrosalinda.pages.dev

Source: irisqrosalinda.pages.dev

2024 Tax Brackets Married Filing Separately Carin Cosetta, And is based on the tax brackets of 2023 and.

Category: 2024